What should be Included in an Invoice to Be Legally Valid?

How to correctly draw up an invoice so that it is legally valid? What items must an invoice contain?

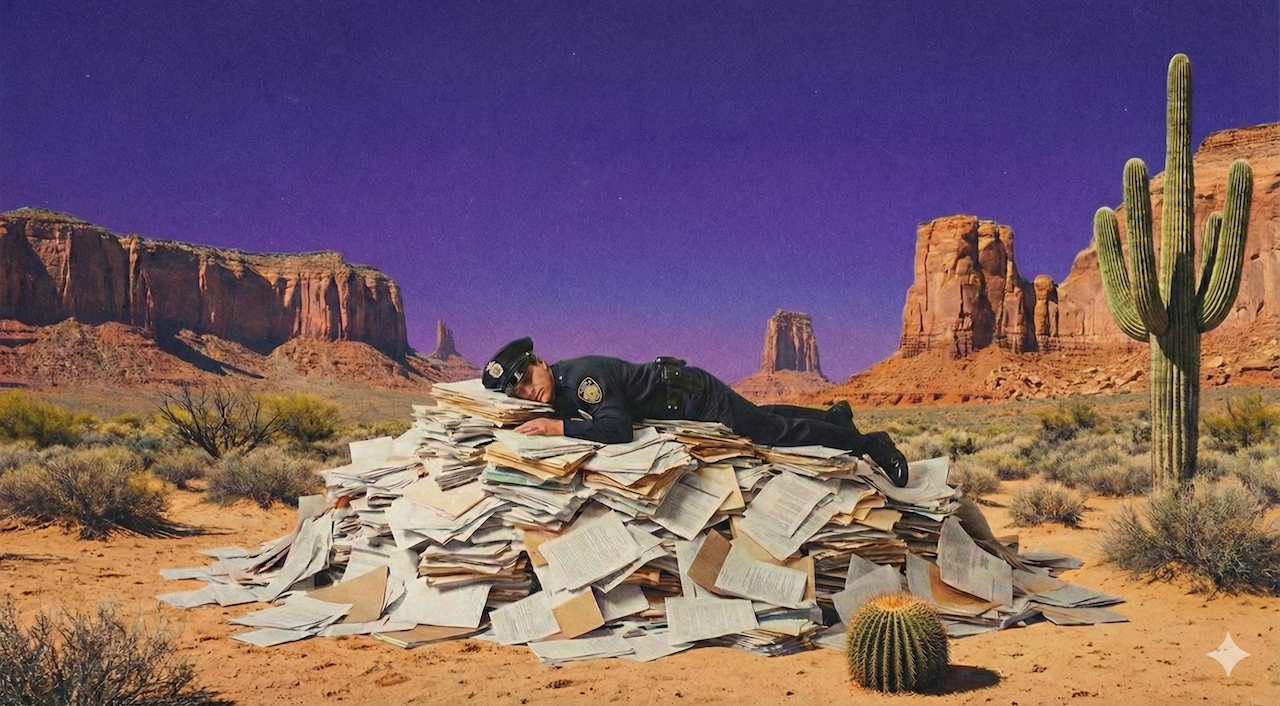

An invoice is a small document with surprisingly big consequences. One missing detail can delay a payment, raise questions from a client, or leave you wondering whether you’ve done everything “by the book.” That uncertainty is often more stressful than the paperwork itself.

The good news is that invoices aren’t a mystery — they follow a clear and logical structure. Let’s walk through the five elements an invoice must include to be legally valid in most European countries together.

1. Clear business details — yours and your client’s

An invoice must clearly identify both parties involved. This helps establish the legal relationship behind the payment.

Your invoice should include:

- your full legal name or registered business name

- your address

- your client’s legal name and address

If you’re a freelancer or sole trader, your personal name is usually sufficient. You don’t need complex branding — what matters is that the information is accurate and easy to understand. This clarity protects both sides and prevents confusion later.

For example:

Service Provider:

Anna Müller

Musterstraße 12, 10115 Berlin, Germany

Client:

Bright Solutions GmbH

Friedrichstraße 45, 10969 Berlin, Germany

2. A unique invoice number for traceability

Every invoice needs a unique identification number. This is one of the most important technical requirements.

The invoice number allows:

- tax authorities to track transactions

- clients to reference payments

- you to stay organised during tax reporting

There’s no strict format, but numbers should be sequential and never repeated. Many people start with something simple like “2025-001.” A simple invoice generator removes this mental load entirely by assigning numbers automatically.

For example, this could look like:

Invoice number: INV-2025-004

(the fourth invoice you issued in 2025)

3. Invoice date and payment terms

Dates create structure. A valid invoice should always show:

- the date the invoice was issued

- the payment due date or payment terms

For example: “Payment due within 14 days.” This protects your cash flow and sets clear expectations. Without this, late payments become harder to challenge — and emotionally harder to follow up on.

For example, this could look like:

Invoice date: March 3, 2025

Payment due: Within 14 days (by March 17, 2025)

4. Detailed description of services and amounts

This section explains what the client is paying for.

It should include:

- a short, clear description of services or goods

- quantity, hours, or project scope (if relevant)

- net price

- VAT amount (if applicable)

- total amount due

Even if you make your own receipt manually, transparency here is essential. Clear descriptions reduce disputes and help clients process payments faster.

For example, this could look like:

Website content writing – March 2025

5 articles × €200

Subtotal: €1,000

VAT (19%): €190

Total: €1,190

5. Tax information and legal notes (when required)

Depending on your tax status and country, you may need to add:

- your VAT number

- applied VAT rate

- a VAT exemption note, if you don’t charge VAT

This part often causes the most anxiety, especially for new freelancers. If you’re unsure, templates and tools are your safety net — they help you stay compliant without memorising tax law.

For example, this could look like:

VAT ID: DE123456789

or

VAT exempt according to §19 UStG

A gentle reminder before you close the tab

Invoices don’t need to be perfect. They need to be consistent, clear, and complete.

If administrative work feels heavy, that doesn’t mean you’re bad at business. It means you’re doing a lot. Choosing to use a simple invoice generator or structured templates is not a shortcut — it’s a way to protect your time, your focus, and your peace of mind.

Once the structure is in place, the rest becomes easier. And you get to spend more energy on the work you actually enjoy.